Building a Systematic Trading Framework That Actually Works

Discover the step-by-step process to create a trading system that removes emotion and delivers consistent results through disciplined execution.

Tradris Team

Building a Systematic Trading Framework That Actually Works

Most traders fail because they trade on impulse rather than system. Here's how to build a framework that removes emotion and delivers consistency.

What Makes a Framework "Systematic"?

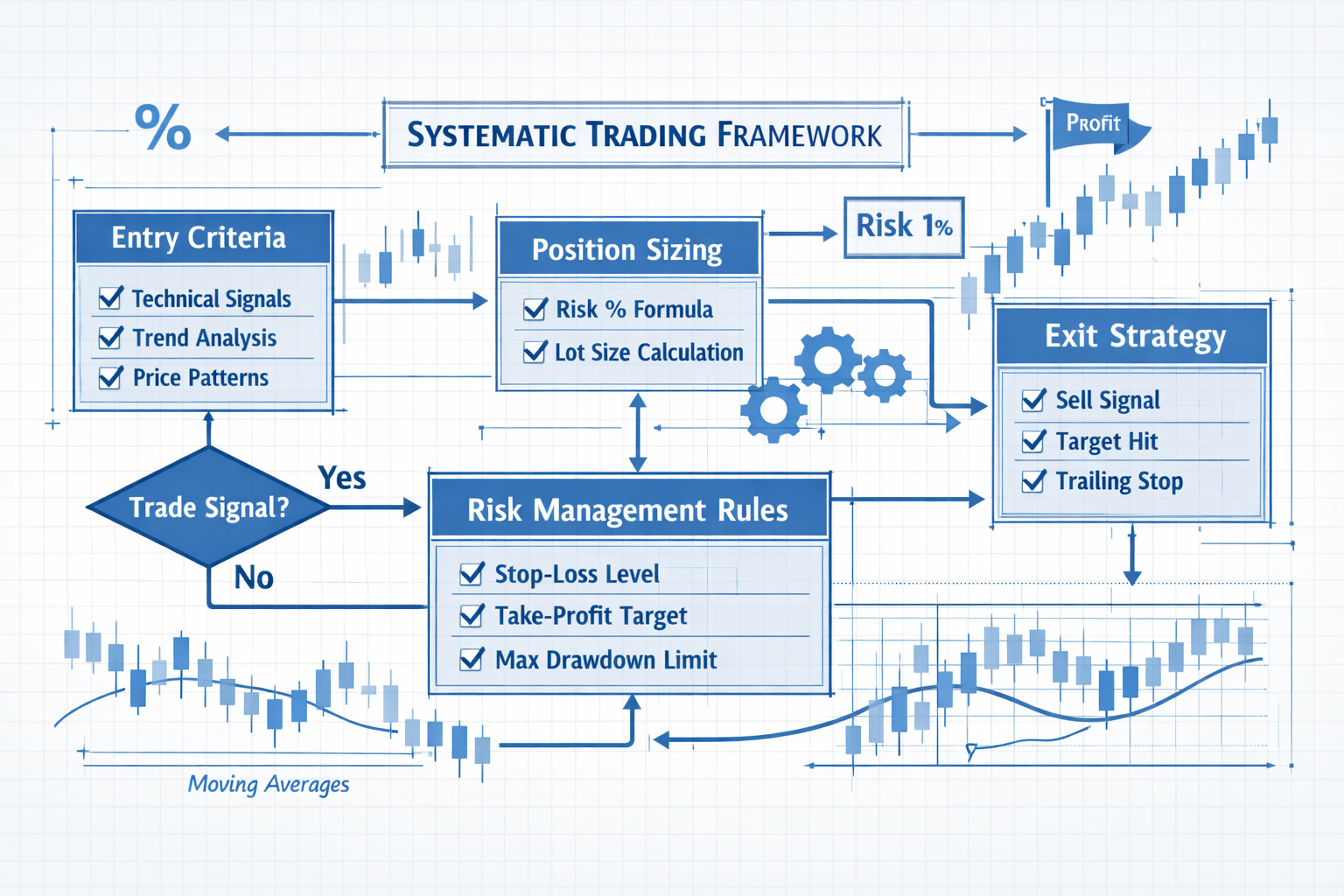

A systematic trading framework has three core components:

- Objective Entry Rules - Clear, measurable criteria for when to enter trades

- Defined Risk Management - Predetermined position sizing and exit rules

- Consistent Execution - Following the system regardless of emotions

The 4-Step Framework Development Process

Step 1: Define Your Market Edge

Your edge isn't just a pattern—it's a statistical advantage you can measure and repeat.

Example Edge Definition:

- Market: Nifty 50 futures during regular trading hours (9:15 AM - 3:30 PM)

- Setup: Pullback to 20-period moving average after 3+ day uptrend

- Entry: Break above previous day's high with volume confirmation

- Expected win rate: 65% based on 200+ historical samples

Step 2: Create Objective Rules

Transform your edge into specific, measurable rules:

ENTRY CRITERIA:

- 20-period MA sloping upward for 3+ periods

- Price closed below 20-period MA for 1-2 days

- Current price breaks above previous day's high

- Volume > 1.5x average daily volume

- Time: 9:15 AM - 3:30 PM IST only

POSITION SIZE:

- Risk 2% of account per trade

- Position Size = (Account × 0.02) ÷ Stop Loss Distance

EXIT RULES:

- Stop Loss: 2 ATR below entry

- Target 1: 1.5x risk (remove 50% position)

- Target 2: 3x risk (remove remaining 50%)

- Time Stop: Exit at 3:15 PM if still open

Step 3: Backtest and Validate

Test your framework on historical data to understand its performance characteristics:

- Win Rate: Percentage of profitable trades

- Average Win/Loss Ratio: How much you make vs. lose per trade

- Maximum Drawdown: Worst losing streak you can expect

- Profit Factor: Gross profit ÷ Gross loss (should be >1.25)

Step 4: Implement with Discipline

The best framework is worthless without consistent execution. This is where most traders fail.

Common Framework Failures

The "Discretionary Override" Trap

You create rules, then break them when you "feel" the market is different. This destroys your statistical edge.

The "Optimization Addiction"

Constantly tweaking rules based on recent performance. This leads to curve-fitting and poor forward results.

The "Perfect Setup" Syndrome

Waiting for the "perfect" trade instead of taking all valid setups. This reduces your sample size and statistical reliability.

The Tradris Systematic Approach

Our platform helps you build and maintain systematic discipline:

Framework Builder: Create objective rules with our guided templates Backtest Engine: Test your framework on historical data Execution Tracker: Monitor adherence to your rules Performance Analytics: Measure framework effectiveness over time

Sample Framework: The Momentum Pullback System

Here's a complete framework you can adapt:

Market Selection:

- Liquid ETFs (NIFTYBEES, BANKBEES, JUNIORBEES) during regular hours

- Minimum average daily volume: 50 lakh shares

Entry Setup:

- 5-day moving average > 20-day moving average (uptrend)

- Price pulls back to touch 20-day MA

- RSI(14) between 40-60 (not oversold/overbought)

- Entry on break above previous day's high

Risk Management:

- Risk: 2% of account per trade

- Stop: 1.5 ATR below entry

- Target 1: 2R (remove 50%)

- Target 2: 4R (remove 50%)

- Maximum 3 positions simultaneously

Trade Management:

- Move stop to breakeven when Target 1 hit

- Trail stop by 1 ATR on remaining position

- No new trades in final 15 minutes of session

Measuring Framework Success

Track these key metrics monthly:

Execution Metrics:

- Rule adherence rate (target: >95%)

- Number of valid setups taken vs. available

- Discretionary overrides (target: 0)

Performance Metrics:

- Win rate vs. backtested expectation

- Average R-multiple per trade

- Maximum drawdown vs. historical

Psychological Metrics:

- Emotional state during trades (journal entries)

- Sleep quality on trading days

- Stress levels (1-10 scale)

Building Your First Framework

Start simple with these steps:

- Choose one market you understand well

- Define one setup you've observed repeatedly

- Create 5-7 objective rules for entry and exit

- Test on 50+ historical examples manually

- Trade small size for 20+ live trades

- Measure and refine based on data, not emotions

The Long-Term Advantage

Systematic frameworks compound over time:

- Consistency builds confidence and reduces stress

- Data collection allows continuous improvement

- Emotional stability prevents costly mistakes

- Scalability enables position size increases as account grows

Remember: The goal isn't to be right on every trade—it's to be consistently profitable over hundreds of trades.

Ready to build your systematic trading framework? Join Tradris and access our framework builder, backtesting tools, and execution tracking system.